Alwaght- Stocks across the Persian Gulf Arab states tumbled as the removal of unjust sanctions against Iran raised the prospect of a surge in oil supplies to a market already reeling from the lowest prices in more than a decade. Meanwhile shares in Tehran gained.

According to the Daily Telegraph, stock markets across the West Asia region saw more than £27bn wiped off their value adding that Iran is set to flood the world oil market with millions of barrels of crude oil after the lifting of sanctions.

Panicked traders scrambled desperately to sell off their stakes in Iran’s regional rivals including Saudi Arabia and the United Arab Emirates, whose economies are hugely dependent on the price of crude oil.

Panicked traders scrambled desperately to sell off their stakes in Saudi Arabia and the United Arab Emirates, whose economies are hugely dependent on the price of crude oil.

Iran’s stock market was the only one to benefit from Saturday night’s announcement of sanctions relief, gaining one per cent as optimism grows over the Islamic Republic’s economy.

This is while Saudi Arabia's Tadawul All Share Index collapsed by seven per cent to 5,409.35, its lowest level in almost five years.

The UAE also suffered heavily, with Dubai's DFM General Index slumping by 4.8 per cent to 2,682.56.

Saudi Arabia’s stock market, which is the region’s biggest one, has tumbled an astonishing 20% this month alone as it struggles to readjust its economy to cope with oil prices in free-fall. Egypt's market also hit its lowest point in two years.

Saudi Arabia, the largest exporter of crude oil in the world, responded to the falling crude prices by introducing new austerity measures to stabilize government finances last year. However, with prices at a 12-year low, oil dependent economies of Saudi Arabia, Kuwait, Oman, Qatar and the United Arab Emirates could see more spending cuts in 2016.

Crude oil has shed more than 75 per cent of its value since last summer and now sells for less than $30 a barrel on the international markets, down from a high of 140 per cent at the height of the world financial crisis in 2010.

Meanwhile on Sunday, Iranian President Hasan Rouhani has presented the parliament, Majlis, with a draft budget that would reduce the government's reliance on oil revenues. The budget plans for an economic windfall as international economic sanctions against Iran end as part of a landmark nuclear deal.

The $75 billion budget, unveiled Sunday, is about 4.2 percent higher than the previous year's budget of $72 billion.

- Trump Pressures Canada: Buy $61 Billion Defense System or Accept US Statehood

- Iran Unveils Initiative to Generate 20,000 Megawatts of Nuclear Power, Says AEOI Chief

- Iran and Oman Ink 18 Memorandums of Understanding During President Pezeshkian’s Visit

- New Israeli Airstrike Targets Sanaa Airport in Yemen

- Under Fresh Strategy, Netanyahu Focusing on Breaking Gazans’ Will

- Why’s Pres. Pezeshkian’s Oman Visit Important?

- Iran and Pakistan: Convergence in Regional Crises

- Long-Term Political Cooperation Framework Agreement to Be Signed by Iran and Oman

- Qalibaf Re-elected as Speaker of Iran’s Parliament

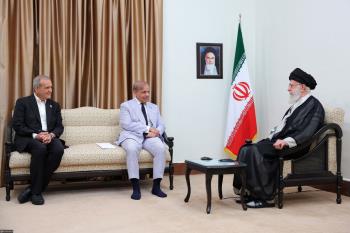

- Iran’s Supreme Leader Advocates Joint Action with Pakistan Against Israeli Aggression

Editor's Choice

Iran and Pakistan: Convergence in Regional Crises Tehran and Islamabad bear the potential to work for a stronger relationship that contributes to regional peace and stability.

Iran’s Firm Stance in Nuclear Talks Disallows Another Libya Scenario The West should know Iran is not Libya and even heavier pressure cannot bring Iran to its knees.

Is Trump Mulling Shift in Gaza Strategy? Trump may temporarily offer initiatives to ease public pressure, but he cannot persuade Netanyahu to end his Gaza war.

India-Pakistan War Showcased China’s Arms Power against West Recent war has unveiled Western weapons weakness amid thriving Chinese military technologies.

Hunger for Petrodollars: What to Expect from Trump’s Persian Gulf Tour? The US president is expected to make a set of economic and security deals with Arab countries.

News

Trump Pressures Canada: Buy $61 Billion Defense System or Accept US Statehood

Donald Trump, President of the US, has stated that Canada is required to contribute $61 billion to the ’Golden Dome’ missile initiativeIran Unveils Initiative to Generate 20,000 Megawatts of Nuclear Power, Says AEOI Chief Iran has begun implementing a plan to produce as much as 20,000 megawatts of electricity from peaceful nuclear activities

Iran and Oman Ink 18 Memorandums of Understanding During President Pezeshkian’s Visit During Iranian President Masoud Pezeshkian’s official two-day visit to Muscat, Iran and Oman signed 18 memoranda of understanding across a range of sectors

New Israeli Airstrike Targets Sanaa Airport in Yemen Israeli warplanes launched renewed strikes on Sana’a Airport, damaging a Yemenia Airlines jet days after the airport resumed activity

Long-Term Political Cooperation Framework Agreement to Be Signed by Iran and Oman One of the most significant agreements to be signed during President Masoud Pezeshkian’s visit to Muscat is the Long-Term Political Cooperation Framework

Qalibaf Re-elected as Speaker of Iran’s Parliament Iran’s lawmakers have re-elected Mohammad Baqer Qalibaf as Parliament speaker for the sixth consecutive term

Iran’s Supreme Leader Advocates Joint Action with Pakistan Against Israeli Aggression Ayatollah Seyyed Ali Khamenei, Leader of the Islamic Revolution, underscored Pakistan’s prominent role in the Islamic world

Israel Authorizes Massive Reservist Call-Up to Intensify Gaza Offensive The Israeli government has authorized the mobilization of up to 450,000 reservists under Order 8

Iran Stands in Solidarity with Palestinians, Condemns Israeli Strikes The Iranian Foreign Ministry spokesperson firmly denounced the recent actions by the Zionist regime against Palestinians in the Gaza Strip and the West Bank

Iran Summons French Diplomat Following Barrot’s Allegations In response to baseless accusations by French Foreign Minister Jean-Noel Barrot, Iran’s Foreign Ministry summoned the French chargé d’affaires

Araghchi Warns of Strong Iranian Retaliation Over Potential Snapback Sanctions Foreign Minister Abbas Araghchi warned that Tehran would respond firmly if the "snapback mechanism" is used to reimpose UN sanctions on Iran

Venezuela: Ruling Party Led by Maduro Wins Big in Parliamentary and Regional Votes The United Socialist Party of Venezuela (PSUV), led by President Nicolás Maduro, has emerged victorious in the nation’s elections

Araghchi: Iran Examining Omani Proposal to Break Deadlock in US Talks Iran is currently assessing multiple suggestions from Omani mediators intended to remove persistent barriers to indirect dialogue with the United States

Sheikh Qassem Asserts: Resistance Remains Defiant Amid US, Israeli Pressure The Secretary-General of Hezbollah underscores the Resistance’s role in standing against "Israel", dismisses foreign influence

Army Commander: Iran Is Advancing Systems to Counter Micro Air Vehicles (MAVs) Brigadier General Kiumars Heidari, Commander of the Iranian Army Ground Forces, stated that the Army has developed systems to counter micro air vehicles

Nuclear Chief Affirms Iran’s Refusal to Be Directed by Others Mohammad Eslami, Head of the AEOI, emphasized that Iran is advancing based on its national interests and refuses to be directed by external forces

Yemeni Missile Disrupts Flights at Ben Gurion, Forces Settlers into Shelters A recent missile strike by Yemen’s Armed Forces on Israeli-held areas led to flight suspensions at Ben Gurion Airport

IRGC Warns It’s Ready to Launch Severe Retaliation Against Enemies Iran’s IRGC declared that any act of aggression will provoke an overwhelming response far greater than adversaries can imagine

Netanyahu Grows Uneasy as Trump Alters Policies Donald Trump’s decision to skip Israel during his recent Middle East trip reflects a wider transformation in regional policy

Iran Refuses US Zero-Enrichment Proposal, Warns Deal Could Fall Through Abbas Araghchi, Iran’s Foreign Minister, firmly asserted that Tehran has no intention of ceasing its uranium enrichment

Most Viewed

Iran and Pakistan: Convergence in Regional Crises

Iran and Oman Ink 18 Memorandums of Understanding During President Pezeshkian’s Visit

Iran Unveils Initiative to Generate 20,000 Megawatts of Nuclear Power, Says AEOI Chief

New Israeli Airstrike Targets Sanaa Airport in Yemen

Arab Summit, Baghdad’s Opportunity to Establish Regional Role

Why’s Pres. Pezeshkian’s Oman Visit Important?

Under Fresh Strategy, Netanyahu Focusing on Breaking Gazans’ Will

Trump Pressures Canada: Buy $61 Billion Defense System or Accept US Statehood

Vulnerable Security: Huge Saudi Military Deals only Sink Riyadh Deeper in Reliance on West

Lebanon’s Municipal Election: What Are Its Effects for Hezbollah and Country’s Politics?

Army Commander: Iran Is Advancing Systems to Counter Micro Air Vehicles (MAVs)

From Star Wars to Golden Dome: Is the Game Repeating Itself?

Iran Stands in Solidarity with Palestinians, Condemns Israeli Strikes

From Syria Oil to Iraq Gas: How’s US Seeking to Plunder Regional Energy Resources?

IRGC Warns It’s Ready to Launch Severe Retaliation Against Enemies

Iran Summons French Diplomat Following Barrot’s Allegations

Boiled Frog: How’s US Consuming Syria’s Al-Jolani in a Gradual Trust-making Process?

Iran’s Firm Stance in Nuclear Talks Disallows Another Libya Scenario

Israel Authorizes Massive Reservist Call-Up to Intensify Gaza Offensive

Has France Really Become Supporter of Palestine?

Iran’s Military Adds Three Newly Developed Domestic Drones to Arsenal

Trump Pressures Canada: Buy $61 Billion Defense System or Accept US Statehood

Stop or Continue? Netanyahu Facing Fatal Gaza War Dilemma

New Syria and the Project to Remove Palestinian Resistance Factions from Damascus

UNRWA Reveals Disturbing Abuse of Gaza Aid Workers in Israeli Custody

Failed Mission: Tel Aviv Running into Impasse on Yemen

Araghchi Confirms Rome Will Host Next Iran-US Talks After E3 Meeting

Iran Criticizes US Airstrike on Migrant Detention Facility in Yemen

Israel and HTS: Two Blades of the Same Sword Tearing Apart Syria

Hunger for Petrodollars: What to Expect from Trump’s Persian Gulf Tour?

US President Trump Arrives in Saudi Arabia for a $1 Trillion Deal

Qalibaf Calls Israeli Threats Baseless, Says Aim Is to Disrupt US-Iran Talks

Yemen’s Air Defense a Tough Test for US Air Superiority

India-Pakistan War Showcased China’s Arms Power against West

Is Trump Mulling Shift in Gaza Strategy?

Foreign Actors Involved in India-Pakistan Crisis: Expert

Indian Muslims Falling Victim to Hindu and Takfiri Radicalism

How Can India-Pakistan War Impact Central Asia?

In Focus

Ansarullah

A Zaidi Shiite movement operating in Yemen. It seeks to establish a democratic government in Yemen.

Shiite

represents the second largest denomination of Islam. Shiites believe Ali (peace be upon him) to be prophet"s successor in the Caliphate.

Resistance

Axis of Resistances refers to countries and movements with common political goal, i.e., resisting against Zionist regime, America and other western powers. Iran, Syria, Hezbollah in Lebanon, and Hamas in Palestine are considered as the Axis of Resistance.

Persian Gulf Cooperation Council

A regional political u n i o n consisting of Arab states of the Persian Gulf, except for Iraq.

Taliban

Taliban is a Sunni fundamentalist movement in Afghanistan. It was founded by Mohammed Omar in 1994.

Wahhabism & Extremism

Wahhabism is an extremist pseudo-Sunni movement, which labels non-Wahhabi Muslims as apostates thus paving the way for their bloodshed.

Kurds

Kurds are an ethnic group in the Middle East, mostly inhabiting a region, which spans adjacent parts of Iran, Iraq, Syria, and Turkey. They are an Iranian people and speak the Kurdish languages, which form a subgroup of the Northwestern Iranian branch of Iranian languages.

NATO

The North Atlantic Treaty Organization is an intergovernmental military alliance based on the North Atlantic Treaty which was signed on 4 April 1949.

Islamic Awakening

Refers to a revival of the Islam throughout the world, that began in 1979 by Iranian Revolution that established an Islamic republic.

Al-Qaeda

A militant Sunni organization founded by Osama bin Laden at some point between 1988 and 1989

New node

Saudi, Arab States Stock Markets Collapse, Billions Lost as Iran Rises