Alwaght- The International Monetary Fund says Saudi Arabian economy growth will be hindered by lower oil productions.

The Fund says previously estimated figures for the economic growth in the Arab country should be revised and reduced based on the current facts.

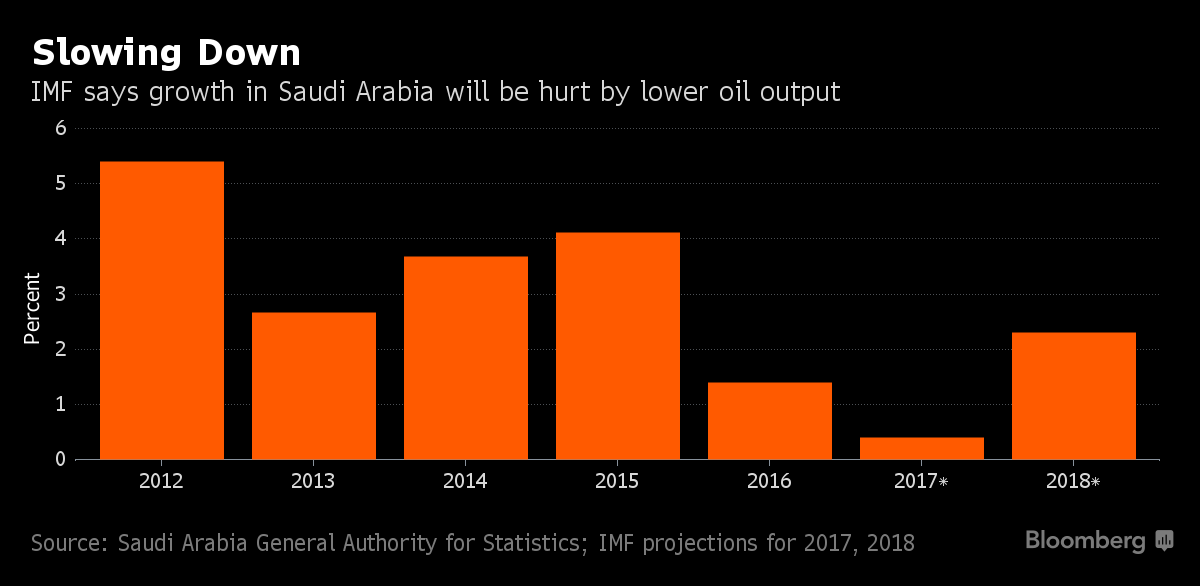

Citing the impact of the recent deal by the Organization of the Petroleum Exporting Countries to reduce output, the latest version of the report has reduced its estimate from 2 percent, preciously declared in October, to just 0.4 percent.

The forecast reflects cuts in government spending as well as the impact of lower oil production, Gian Maria Milesi-Ferretti, deputy director of the IMF’s research department, told reporters on Monday. “There is a big adjustment in spending downwards,” he said. “There is an adjustment in taxes upwards, and as a result non-oil growth is not going to be as good as it was during periods of strong oil prices.”

Saudi Arabia is seeking foreign investment to plug one of the West Asia’s biggest budget deficits. The kingdom is planning to borrow as much as $15 billion this year on international debt markets to help fund its spending plans, following last year’s $17.5 billion sovereign bond sale.

“It will take time to diversify the economy in a meaningful way,” said Monica Malik, chief economist at Abu Dhabi Commercial Bank. “Saudi remains dependent on oil; and at the current prices, the ability of the government to stimulate growth is limited.”

Saudi Arabia estimates growth fell to 1.4 percent in 2016, the lowest since the recession in 2009, as it cut spending by suspending bonuses for public employees and reducing ministers’ salaries. The government has also raised the cost of fuel, and plans to introduce value-added taxes and fees on expatriate workers.

The government plans to increase debt levels to 30 percent of economic output by 2020, from 7.7 percent, according to targets set out in June.