Alwaght- The US Secretary of State Mike Pompeo on Monday stated that Washington will not renew the waivers to major Iran oil customers after their expiration, adding that from now on those not following the ban on the Iranian crude will face tough economic sanctions. Responding to the hostile stance, Iran called the ban totally illegal and warned about the “grave and destabilizing” consequences of the White House decision.

Alwaght has talked to Mohammad Ali Sadeghi, an energy expert, and Husein Hanizadeh, a political analyst, asking them what Trump administration’s latest move against Tehran will mean.

Alwaght asked Mr Sadeghi that how capable the US is to force to zero the Iranian oil exports, having in mind that Saudi Arabia and the United Arab Emirates have expressed readiness to make up for the shortage in the market.

Mr Sadeghi replied that it is not possible for Washington to push to zero the Iranian oil supplies for a couple of reasons.

“First, I should tell you that oil is a strategic product and Iran certainly finds buyers to its oil. For example, the US is the largest consumer of Venezuelan oil. When Washington sanctioned Caracas, it had to find alternatives to the Venezuelan crude. Before D’Amato sanctions came into effect, Iran was exporting around 800 oil barrel every day to the US. When the ban was implemented in 1997, Iran shifted its course and sent its oil to the European customers.”

One important way is offering cheap oil to foreign customers, according to the Iranian energy expert. “The cost of oil production per barrel in the North Sea is $17, in Russia $30, and for the US shale oil $70,” he went on, adding that “this is while the cost of crude production for Iran in the Persian Gulf oilfields is only $5.”

An important thing, he continued, is that it is not that easy to find an alternative for the Iranian oil by the major customers of Tehran. The refineries and oil terminals of the Iranian oil customers need structural and of course costly changes to their facilities in order to customize them to new oil. This adds to the complexity of the matter. “In fact, the US by making such a show move seeks to prevent possible volatilities in the oil markets.”

Should China obey the US sanctions regime, it has to face over $2 billion in damages. The past experiences prove that Beijing has never been fully accordant with the US anti-Tehran sanctions as Washington leaders hoped. “At the time being, the big Chinese energy companies, mainly the state-run ones, may dither over whether to buy the Iranian oil anymore, but the smaller and private companies which have no large-scale business ties with the US will negotiate discounted oil purchases from Iran.”

Alwaght asked Mr Sadeghi for a comment on the repercussions of the anti-Iranian step on the global oil markets. He said that apparently there would be influences on the oil market. For now, the average price for OPEC oil barrel is $72. The market is witnessing its volatility taking effects from a set of factors like imbalance of demand and supply, the seasonal conditions, and the major oil consumers’ economic slowdown. “If the US wants to take a dramatic measure against the Iranian oil exports, the oil prices will definitely rise.”

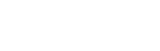

“Last week, White House added to its terror list Islamic Revolutionary Guards Corps (IRGC) while it is an official military. And now it seeks to block Iran’s oil sales. What do you think is the goal behind the new wave of the US pressure campaign?” Alwaght asked Mr HaniZadeh.

The expert responded that Americans gradually intensify the pressures on Tehran majorly because Washington’s policies in Syria and Iraq have met their failure. The US has now embarked on more aggressive policies using such regional instruments as Saudi Arabia and the Israeli regime all to change the region’s geographical and political map for the good of its, and Tel Aviv’s, interests.

“The reality is that Iran’s active presence in the regional cases like Syria and Iraq foiled Washington’s plans. Now the US regional position is in its nadir. The Americans have to, unavoidably, pay a high price to change the regional conditions. They find Iran the main source of their regional schemes’ failure.”

Trump’s unilateral pullout of the nuclear deal with Iran, Mr Hanizadeh went on, was to pave the way for foisting new sanctions on Iran while the American administration was desperate to see the international atmosphere reject to side with it in its destabilizing policies. Through breach of international law and use of power, Trump strives to make other international actors patrons to its anti-Tehran policies in a hope to close the doors of global business to Iran. “This policy will fail in the long run because Iran has many cards to play against the embargo.”

Touching on the reaction of the major customers of Iran's oil to the waiver halt, Mr Hanizardeh responded: “China is a country with little interest to engage in the international disputes. It tries to move along with Washington to allow its decades-long economic growth to continue. Beijing’s policies are ancillary to China’s economic priorities. With regard to the huge volume of China-US trade, the Chinese are not expected to resist the White House sanctions. Still, there are some countries like India, South Korea, and Turkey that need Iranian oil. They will have their own channels to do business with Iran and buy oil from it.”

Asked about the Iranian solutions in the face of the oil embargo, Mr Hanizadeh asserted that Iran has its own mechanism to deal with the unilateral ban. “It works with the European Union within the nuclear deal path. Also, it does business with regional countries like Iraq, Turkey, Pakistan, India, and Afghanistan. Russia can also be a significant trade and energy partner to Iran. So, with regard to the tactics Iran has already designed to confront the ban, Washington is far from managing to bring Iran to knees using oil embargo.”