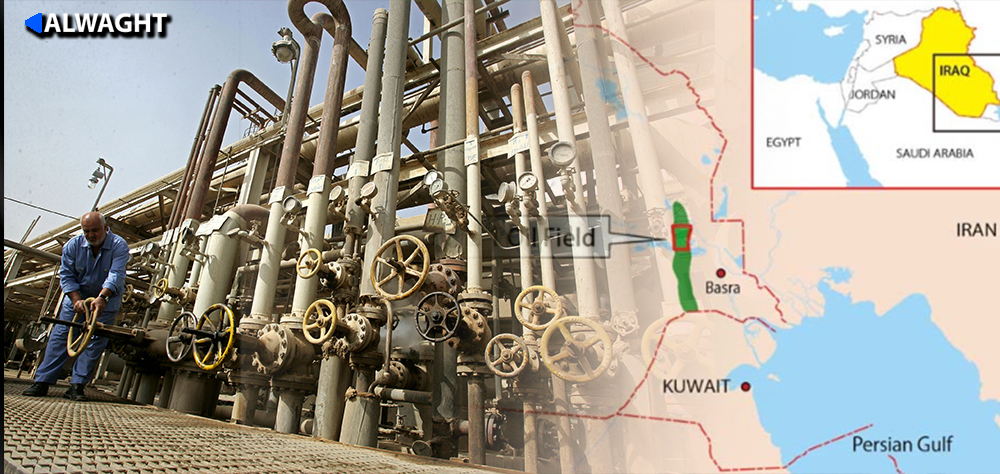

Alwaght- While all figures signal that Iraq is in dire straits economically, the central government asked to buy 32.7 percent in the ExxonMobil share in the West Qurna 1 oilfield in association with Basra Oil Company(BOC). The decision to by the oil share came as the political observers and even the government officials are concerned about broader budget deficit for the current year.

Why is the Iraqi government trying to buy part of ExxonMobil share? To this question, we need to bring in spotlight Baghdad’s steps for long-term investment for economic improvement with a special reliance on the energy exports.

Long-term oil investment to increase gas and oil exports

The Iraqi government's attempt to buy shares in ExxonMobil in the West Qurna 1 oil field could, in a nutshell, can be linked to the country's plan for long-term investment in oil exploration fields. The West Qurna 1 oilfield is one of Iraq's biggest oil industry achievements in the reconstruction era that followed the Second Persian Gulf War. The American company rose in 2010 to become the largest contractor of the oilfield. But the tough terms of the deal, delays in payments, declining OPEC production and political instability marred the oil field's attractiveness in recent years. Meanwhile, the coronavirus outbreak and the global financial markets' slump have hit the US oil industry giant ExxonMobil hard, with debts now estimated at more than $70 billion.

In 2019, Exxon sought to initiate a $53 billion project to increase Iraq's oil output. But with the sale of this share, it is introducing a major change in its plan. Evidence now suggests that the company is seeking to sell its $350 million stake, and that the ministries of oil and finance will follow the procedure to finance the purchase, said Khalid Hamza, the director of the BOC. The Iraqi government, with the purchase of a 32% stake in Exxon, would have to manage the West Qarna 1 with other partners. Other foreign shareholders include PetroCheina with 32.7 percent, Japan's Itochu Corporation with 19.6 percent and Indonesia's Pertamina with 10 percent. The remaining share, 5 percent, is held by the Iraqi Oil Exploration Company (OEC).

The purchase operation demonstrates that the Iraqi government is trying to buy with a relatively low price the American company's share as Baghdad predicts boost for the global financial markets, rise in the demand for energy, and restart of the industrial activities with full capacity when the Covid-19 crisis ends. The share can serve the income level boost in a time of economic reactivation. Certainly, holding shares in the oil exploration and production can play a special role for Baghdad incomes in the future.

Oil incomes remain top remedy to the crisis-hit Iraqi economy and driving force for development

Another important issue about Iraqi government's efforts to buy ExxonMobil shares in the Basra oil fields is related to the country's efforts for economic management and reconstruction of the country. Three issues are important to consider: First, Iraq's economy is singe-product and dependent on the oil incomes. Oil revenues accounts for 95 percent of the Iraqi incomes. The country faced a serious crisis in recent years as oil prices slumped and the pandemic remarkably cut the demands for energy.

Second, the Iraqi public payment budget annually is $96 billion. This means that Baghdad needs to sell around 1.1 billion oil barrels with a price of $80 each to provide for its budget.

Third, the OPEC Plus oil output cap is important to consider. According to the May 2020 agreement, Iraq's oil production quota is 3. 857 million barrels per day by the end of April, of which more than 550,000 barrels per day is consumed to fuel refineries and federal power plants, and the rest is for export. However, the issue now is that the Iraqi government is under intense pressure from OPEC members to reduce production and compensate for excessive production in recent months. This means that the Iraqi government will have to export between 2.8 and 2.9 million barrels daily, and the Iraqi Kurdistan region will have to export about 400,000 barrels.

In January, Baghdad oil exports per day was 2.868 million barrels on average. Kurdistan region in the north exported 397,000 barrels daily. This amount in February was 3.305 and in March 3.280 million barrels. According to a recent OPEC Plus deal, the Iraqi share in May increased to reach 3.905 million barrels per day.

Meanwhile, the figures show that the Iraqi government even with consideration of the internal consumption can meet the OPEC plus share. The amount of oil produced in Iraq, for example, was protested by OPEC Plus members in February, with members describing it a "violation" of the cap. The problem is that on the one hand, Iraq's oil-dependent economy needs $80 oil to manage its economic crisis, and even increase its oil exports to 4 million barrels per day, but the OPEC Plus members not only do not consider such waiver for Baghdad but also they push the Iraqis to cut production by 500,000 daily to make up for the excess in the past months.

Optimistic about global energy price rally after May, the Iraqi government hopes to manage the situation with expansion of oilfields and a special focus on gas exports. As part of its roadmap, the central government recently announced plan to invest $3 billion in the Basra Gas Company for the next five years to increase output by 40 percent to 1.4 billion square feet per day. For an income growth, it also intends to increase light oil production 100,000 barrels daily to reach 1.1 million.