Alwaght- In the past two decades, the Turkish President Recep Tayyip Erdogan has shown that he is a perfect miracle worker in the face of the dangers that shake the pillars of his rule, to an extent that he always has trump cards to play with. He is, indeed, not alone and from time to time, and when the problems pressure him, turns to foreign friends as last resorts. Now, like before, less than a year to the parliamentary and presidential elections, Erdogan is setting his hopes on wealthy Muslim Brotherhood partner in the Persian Gulf.

Some sources said that Qatar is going to provide $10 billion in financial aid to Turkey, of which about $3 billion will be provided to Ankara by the end of this year and the rest will be delivered next year. A Turkish official said the entire finances could be in the form of swaps, bonds or other methods, and Turkish and Qatari leaders have already discussed the matter.

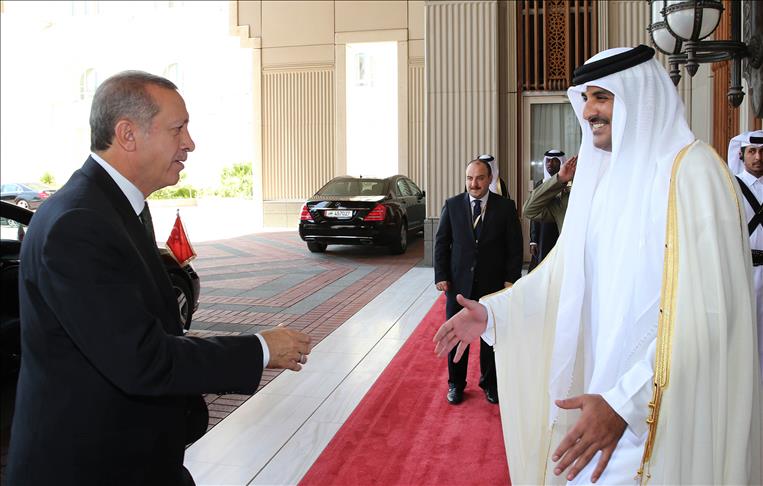

At the same time, the spokesman of the Saudi Ministry of Finance said a few days ago that Riyadh and Ankara are in the final stage of negotiations on Riyadh's deposit of $5 billion in the Turkey’s central bank. These financial aids, which can save the Turkish economy from the current disastrous situation, were announced after the Turkish President Recep Tayyip Erdogan traveled to Doha last week to participate in the opening ceremony of the World Cup, where he also met the Saudi Crown Prince Mohammed bin Salman and the two had a handshake.

After several years of political tensions, Turkey and Saudi Arabia have recently normalized their relations and Riyadh seems to plan investments in various Turkish economic sectors. Two weeks ago, the Saudi Council of Ministers, chaired by the king, approved new measures to encourage direct investment in Turkey, which will be implemented after the final approval. According to reports, the Saudi investments in Turkey are currently around $18 billion, and this can grow larger with additional $5 billion and return of the Saudi investors to Turkey.

Saudi relations with Turkey in recent years have been strained amid heated regional competition, and since there is no trust between the leaders of Ankara and Riyadh, the claim of $5 billion deposit in the Turkish central bank may just remain words. In the past two years, Saudi Arabia has increased its military and economic cooperation with Greece, which is Turkey's foe, rendering Ankara discontented. Earlier, the UAE had made generous promises to invest in Turkey's economic sectors, but Abu Dhabi rulers are not very interested in developing relations with Ankara, and no action has been taken by Saudi Arabia or Abu Dhabi to provide financial assistance to Turkey in practice.

Stretching hands to Qatar for help

Having in mind that Erdogan does not count on the Saudi promises, he is resorting to the Qataris for finances to help patch things up in the embattled economy. Qatar's $10 billion financial aid is motivated by the strong relations between the two countries, which has resulted in frequent meetings between the officials of the two sides.

Turkey and Qatar are strategic partners whose cooperation has expanded since the Persian Gulf crisis in 2017 when Ankara increased its military presence to protect Doha against a possible coup assisted by the Saudis. At that time, Turkey sent hundreds of its military forces to Qatar to defend the country's government against the threats posed by Saudi Arabia and its allies, and even built a military base in Doha to closely monitor Saudi-led alliance's movements. The Qatari leaders, who owe part of their internal stability to Turkey's military aids, are trying to throw their financial weight behind Turkey using their huge riches.

Before the crisis in the (Persian) Gulf Cooperation Council, Qatar's investments in the Turkish economy were around $1 billion and in 2017, they surged to $6.2 billion. This amount grew dramatically in the past four years. In August 2018, after a meeting between Erdogan and Qatari Emir Sheikh Tamim bin Hamad Al Thani, Doha promised $15 billion in direct investments in Turkey's economy.

Qatar's investments in Turkey span all sectors, and accordingly, in September, Qatar announced that it had acquired a stake in the Eurasia Tunnel in Istanbul. Qatar's notable investments in Turkey range from DigiTurk cable TV platform to Finance Bank, Istanbul Stock Exchange and Istinye Park shopping center. Qatar's investments are so extensive that some of Erdogan's opponents have spoken out, arguing that the government is quietly selling everything in Turkey to the Arabs.

While less than 1 percent of Turkey's Finance Bank shares are publicly traded, in recent years its market value has exceeded $40 billion, about $10 billion more than the value of Turkey's six largest private lenders combined, and has reached about 20 percent of the total value of the Istanbul Stock Exchange. Market observers label such a sharp increase unusual and suggest that Qatar has invested heavily in the bank.

Qataris have also invested in Turkey's largest streaming service, BMC armored vehicles manufacturer, Sabah TV Media Group, a chicken producer, and major hotels in the resort town of Marmaris.

The Qatari direct investment in Turkey include estates purchases like luxury palaces on the Busphorus coasts and also lands that are located between Eurasia Tunnel and Sea of Marmara. In addition to direct investments, Qataris have also invested in Turkish stocks and government bonds, but no statistics are available on them.

Qatar has a GDP per capita of over $80,000, while Turkey's is only around $9,000. Turkey typically runs a current account deficit of between $25 billion and $30 billion a year, while oil and gas-rich Qatar enjoys a current account surplus of at least $25 billion, allowing it to invest extensively abroad. According to statistics, by the end of 2021, Qatar had invested $32 billion in Turkey, and considering the expected $10 billion, Turkey will be the first destination for Qatar's foreign investments.

Turkish construction companies say that during the tensions with the Arabs, Qatar provided them with a unique opportunity to showcase their work on a global scale, an opportunity they hope will continue to be available as Doha's relations with the Arabs improve.

Although Turkey's trade volume with Qatar was a little more than $1.5 billion in 2021, Erdogan is eager to bring some of the surplus in the capital of this rich Arab monarchy to the Turkish economy and inject boost into the troubled economy.

In 2022, Turkey's Ministry of Finance took $9 billion in loans, which is part of the $11 billion foreign credit seen for this year. The ministry has projected $10 billion in foreign borrowing for 2023, but could push ahead with debt issuance if needed for preliminary financing. However, it seems that the $10 billion to be granted by Qatar is to pay off these debts next year.

Struggling to beat the inflation

While the Western countries are keeping away from investing in Turkey, Ankara is resorting to the friendly states for finances to push forward with lira backing policy by balancing the dollar demand and supply. Goldman Sachs suggests that between March and September alone, Turkey burned out $17.9 billion of its foreign exchange reserves to maintain the value of lira. The Turkish government seeks to support the lira because, despite the sharp increase in inflation in this country, the Turkish central bank not only did not increase the interest rate, but also reduced it, causing further plunge to lira price.

Turkey has been grappling with a serious economic crisis since 2019 and inflation touched unprecedented 70 percent, making the opposition pan the government. Therefore, Erdogan desperately needs foreign investment and finances to settle part of the problems. Actually, new capital from Qatar works like new blood to the struggling Turkish economy that is currently suffering from sharp increase in fuel prices. Located on East-West confluence, Turkey in recent years signed several energy swap deals with Qatar, China, the UAE, and South Korea both to provide its energy and make profits to improve its weak economy.

Erdogan is striving to secure new foreign capital and investment to the national economy as the election draws closer to increase his victory chance, while the inflation-plagued economy is providing the opposition the best chance to take down Erdogan from two-decade rule. From another perspective, the expansion of bilateral economic interactions are beneficial for Qatar as it is investing in Turkey's tourism and banking sectors to reap the profit in the future.