WSJ Sheds Light on Saudi Crown Prince’s Abuse of State-Linked Business to Get Rich

The heir to the Saudi throne has used businesses connected to government to enrich himself and family members, including a mammoth deal involving Airbus

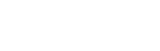

Crown Prince Mohammed bin Salman in London on his first foreign tour as heir to the Saudi throne. ALBERTO PEZZALI/NURPHOTO/ZUMA PRESS

RIYADH—Prince Mohammed bin Salman was a teenager when he realized his father, Prince Salman bin Abdulaziz, was, by Saudi royal standards, a pauper.

While other sons of Saudi Arabia’s founder grew wealthy from government business, Salman, then the governor of this capital city, supported his family with handouts from his brother the king. Mohammed decided to change that, he later told associates.

Nearly two decades later, Salman is king, and Mohammed bin Salman, known as MBS, is the crown prince who says he wants to crack down on corruption and remake the Saudi economy along more modern lines. Prince Mohammed is also fantastically wealthy. In recent years, he has acquired one of the world’s largest yachts, a French palace and a $450 million Leonardo da Vinci painting that was later donated to the United Arab Emirates.

How the prince amassed his wealth exemplifies ways that the autocratic kingdom, essentially a family business, continues to intermingle commercial ventures and Saudi government connections to a degree far from Western norms. While it’s been long known the Saudi royal family keeps a share of the nation’s oil income, other business dealings involving the family’s dominant branch have been held more closely.

Among the connections: Prince Mohammed is managing director—and 20% owner—of a chemical producer that supplies large, state-controlled firms, Saudi corporate filings showed as recently as last year. A company majority-owned by two of the crown prince’s younger brothers was awarded a coveted broadband license from the government, Saudi records showed.

Additionally, in 2015, Prince Mohammed helped engineer a multibillion-dollar deal between European plane giant Airbus SE and Saudi Arabia’s state-owned Saudia Airlines, according to documents reviewed by The Wall Street Journal and interviews with more than a dozen people involved in the transaction. The deal is worth tens of millions of dollars to his family, the documents show.

A spokeswoman for the Saudi embassy in Washington declined to comment about Prince Mohammed’s business dealings.

An Airbus A320, part of the Saudi national airline’s fleet, departs Frankfurt in 2015. PHOTO: ZUMAPRESS.COM

The story of the Airbus deal suggests this mixing of business and government remains a staple of the Saudi economy, despite the crown prince’s highly publicized crackdown on many other royals who the prince said abused their power to get rich. Indeed, Airbus decided to go into business with the king’s family despite its reservations over the blurry distinction between private and public financial interests, according to people familiar with the matter.

An Airbus spokesman declined to comment, saying the company had a policy of not discussing any of its business dealings that could potentially be under investigation by law enforcement agencies.

The modern Saudi state was created in 1932 when Abdulaziz ibn Saud united two regions of the Arabian peninsula and became the first king. American geologists would soon discover oil in the desert, providing a gusher of cash to fund a lavish lifestyle for the royal family.

Many of Abdulaziz’s sons—he had dozens—and grandsons started companies to take on no-bid government contracts or otherwise profit from their political power.

Those practices continued after King Abdulaziz died in 1953 and the crown passed to a succession of his sons. One prince held the country’s only express-mail license, via a joint venture with DHL, the shipping company now owned by Deutsche Post AG , which became an oft-repeated example of how the royal family steered business toward itself. A DHL spokeswoman declined to comment.

Prince Salman didn’t focus so much on gathering wealth, say people close to the family. While his brothers built fortunes, Salman gathered power. He spent 48 years as Riyadh’s governor, overseeing the city’s expansion from a dusty desert enclave to a petrodollar-fueled metropolis of modern skyscrapers and wide boulevards.

Prince Salman prioritized education for his sons—one of Prince Mohammed’s half-brothers became an astronaut and another an Oxford-trained professor, Prince Mohammed has said in recent years.

It was around 2000 when the teenage prince had what he would years later call a shocking realization: His father wasn’t rich.

Salman subsisted on money from his brother, then-King Fahd, Prince Mohammed has told people. He lived a hand-to-mouth existence—if a lavish one—spending the cash on family expenses, rather than saving or investing.

The concerned prince, seeking more financial independence, scraped together about $100,000 to invest in Saudi stocks, he has said.

Prince Mohammed kept trading through college and law school. Through the early 2010s, as his father moved up the royal ranks, he was appointed to a series of government positions. During that time Prince Mohammed made billions of Saudi riyals—hundreds of millions of dollars—on the Saudi stock market, he has told several people interviewed by the Journal.

Prince Mohammed also branched into business. Saudi corporate records as of 2017 show he owns stakes in at least five real-estate development companies, as well as a recycling firm. He is also 20% owner of Watan Industrial Investment Co. Ltd., a chemical producer that supplies state-controlled firms including Aramco, the government’s oil company, the documents show.

A company called Tharawat has emerged as a key player in the business activities of Prince Mohammed’s family. According to Saudi corporate filings, one of his younger brothers, Turki bin Salman, owned 99% of the investment firm as of May 2017, while another brother, Naif, owned the remaining 1%. Prince Turki has since bought his brother’s stake, according to Ammer al Selham, Tharawat’s CEO.

In practice, Prince Mohammed controls and benefits from Tharawat’s business, say several people familiar with their dealings, including two who have discussed the firm with him. Mr. Selham disputed that, saying: “At no time was HRH Prince Mohammed bin Salman a shareholder or a beneficiary of the company.”

Tharawat and a subsidiary own the majority of a tech firm called Jawraa that was awarded a coveted broadband license from the Saudi government in 2014, Saudi records show. The license allowed it to become one of three companies operating new mobile-phone networks in the country.

Tharawat has had interests in fish farms, real estate, tech services, agricultural-commodity trading and restaurants. It owns an office park in Riyadh. An investment vehicle Tharawat owns, Nasaq Holding, says on its website that it is investing in construction to take advantage of “the government’s tenth development plan including investments worth $358.2 billion in real estate.” Saudi corporate filings show that Tharawat owned a company that partnered with Ochsner Health System in New Orleans to bring Saudis to the U.S. for organ transplants.

The kingdom’s struggling flagship air carrier, Saudia Airlines, provided Tharawat with another lucrative opportunity.

In 2014, at the advice of Western “transformation” experts, the money-losing airline reached a tentative deal with Airbus to revitalize its aging fleet. The arrangement would have provided Saudia with dozens of jets financed by the Saudi government’s Public Investment Fund, or PIF, says a person involved in the talks. By agreeing up front to take 50 planes, Saudia would get a major discount.

As it turned out, Prince Mohammed’s family was at that very moment eyeing its own investment in airplanes. Investors in the Middle East had been looking for alternatives to the saturated real-estate market, and airlines were looking to lighten their balance sheets by leasing jets rather than buying them outright.

Tharawat in 2014 acquired a 54% stake in Quantum Investment Bank, a Dubai-based company with scant history of deal making, corporate documents show. Prince Turki, Mohammed’s younger brother, became Quantum’s chairman. Quantum executives didn’t respond to requests for comment, and the bank later took down its website.

Executives from Quantum and another small bank formed a company called International Airfinance Corp., or IAFC, to enter the jet-leasing business.

IAFC became the manager of a fund called ALIF, structured to follow Muslim strictures against paying interest. Airbus agreed to invest $100 million in ALIF if the fund bought only Airbus planes. On June 23, 2014, Airbus and IAFC held a “signing ceremony” in London to announce the new fund, hosted by Prince Turki bin Salman, International Airfinance said in a press release. The fund was aiming to raise $5 billion in equity and debt, deal documents show.

Then, in January of 2015, King Abdullah died and the original Saudia-Airbus plane deal stalled.

Soon after Salman took the throne, Saudi officials told Airbus they had a new plan, say people familiar with the deal: Rather than selling the jets to the Saudi government, Airbus would sell them to ALIF—the fund connected to the bin Salman family—which would in turn rent the planes to Saudia.

People involved in the process say Saudia didn’t solicit competitive bids from leasing companies, and rebuffed the advances of companies seeking to offer competitive rates before choosing ALIF to do the deal.

In response to questions about the deal, Saudia Vice President Abdulrahman Altayeb said in an email that “the aircraft acquisition trans

Saudi Arabia’s Prince Mohammed bin Salman and then-French President François Hollande stand in the background at a June 2015 ceremony ratifying a deal by Airbus to sell 50 planes intended for lease to the Saudi national airline. PHOTO: REMY DE LA MAUVINIERE/EPA/SHUTTERSTOCK

At the time of the deal, some Airbus executives had reservations. Airbus faced investigations into potential corruption overseas by Western law enforcement, including a probe by the U.K.’s Serious Fraud Office into possible bribery by an Airbus subsidiary in Saudi Arabia, and didn’t want further problems. “When I saw Turki was taking over, it kind of brought cold water on all our excitement about the fund,” says a person involved.

Ultimately, this person said, Airbus relented. It was one of the biggest plane deals of the year. Plus, a person involved with the discussions said, Airbus officials decided “we don’t want to prevent the son of the king doing business.”

Others with a stake in the deal were thrilled by the involvement of a Saudi prince. “We took it as a good thing that there were people with deep pockets and political connections that we thought would make this transaction happen,” says one of those people, who says he considered the princes’ involvement “a good risk mitigator” for investors.

Some Saudi officials were left scratching their heads. Within the government and airline, says one official, “everyone thought it makes more sense for the PIF to finance that deal,” since buying 50 planes at once would net Saudia a huge discount. Under the lease deal, Saudia wouldn’t get the benefit of that discount.

Deal documents the Journal obtained and interviews with people involved in the deal detail a convoluted chain of transactions that ends up benefiting Tharawat, the bin Salman company. As one government official put it, “at the end it went to Tharawat, who got others to finance it, and made huge profits without risking any of their money.”

The chain begins with Quantum, the bank Tharawat co-owns, and where Turki bin Salman was appointed chairman. Quantum arranged funding from investors and banks for buying planes, receiving a payment for each equity investment and tranche of debt raised, people familiar with the arrangement say. The ALIF fund raised about $4 billion as of 2017, according to IAFC’s website.

ALIF used the money to buy Airbus planes at a big discount—more than 60% off the list price, say people familiar with the deal. By leasing the planes to Saudia at about market-rate, rather than passing on the discount, ALIF targeted 15% returns. That’s higher than the normal 7% to 9% returns for a fund handling such long-term leases to an airline like Saudia, says Paul Lyons of U.K. aviation-business consultancy IBA Group Ltd.

IAFC, which manages ALIF, has a potentially big upside itself: It stands to get a big chunk of the deal’s profit, even though it doesn’t have any equity in the fund. Deal documents show IAFC gets 35% of profits above 7% return on investment, and 50% of profits above 10%. “That is very high,” says Aldo Giovannitti, who previously researched aviation investments for the World Bank. He says a standard rate would be 10% to 20%.

Mr. Selham, the Tharawat CEO, said neither Quantum nor Turki bin Salman are shareholders of IAFC, which is registered in the Cayman Islands and doesn’t disclose its ownership.

However, IAFC’s operations are intermingled with the bank’s. Quantum’s chief executive is also managing partner of IAFC, and IAFC and Quantum share staff, according to statements by Quantum and IAFC and people familiar with the companies.

A person involved in structuring the deal defended the fund’s high projected returns, and said the lease rate shouldn’t be compared with other airplane-leasing deals. There are few comparable arrangements, this person said, since it involved many planes and an Islamic-finance component that could result in an airline paying higher lease rates.

Prince Mohammed finalized the deal during a 2015 visit to France, says a Saudi official with knowledge of the transaction. Not long after, at a gathering in a Saudi palace, the crown prince took credit for the transaction, according to a person who was present.

“I am the mastermind behind this deal,” the prince said, explaining how it showed his success in balancing state financial interests with his family’s.

Source: Wall Street Journal