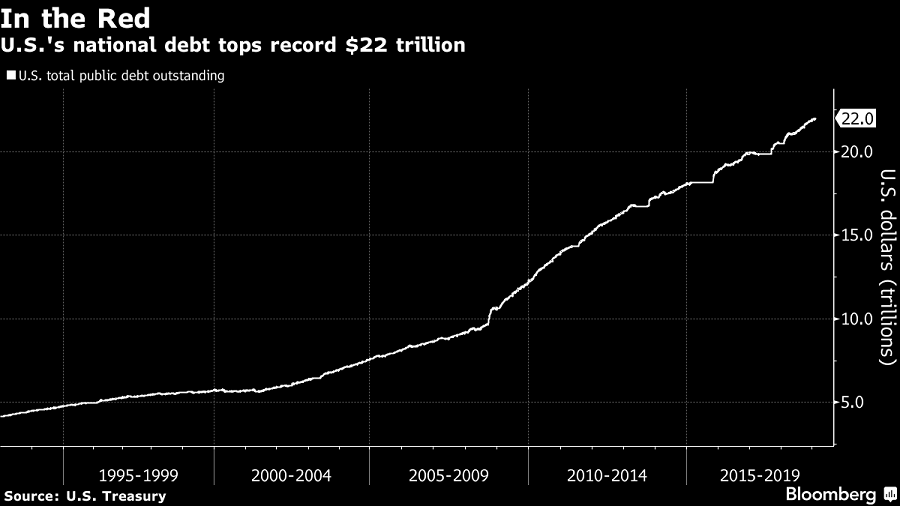

Alwaght- The US national debt has surpassed $22 trillion for the first time in the country's history, signaling that the United States is on an unsustainable financial path.

The US Treasury Department reported the debt hit $22.012 trillion, while it is projected to continue rising by a trillion each year over the next decade, due to the cost of pensions and medical care for the retiring Baby Boomers.

The national debt has been rising at a faster rate following the passage of President Donald Trump’s $1.5 trillion tax-cut package a little more than a year ago and as the result of congressional efforts to increase spending on domestic and military programs. The debt stood at $19.95 trillion when President Donald Trump took office on Jan. 20, 2017. The nation has added more than $1 trillion in debt in the last 11 months alone.

The Congressional Budget Office (CBO) is projecting the deficit for fiscal year 2019 to be $897 billion, a 15 percent increase over last year’s $779 billion – and greater than the entire Pentagon budget, for comparison’s sake. The CBO has estimated the deficit will continue to increase by $1 trillion annually starting in 2022, due to the rising cost of entitlement programs like Social Security and Medicare.

The deficit nearly doubled during the administration of President Barack Obama, growing by $9.3 trillion as the Federal Reserve engaged in massive “quantitative easing” programs to bail out the financial sector from the crash of 2008.

The new debt record “is another sad reminder of the inexcusable tab our nation’s leaders continue to run up and will leave for the next generation,” according to Judd Gregg and Edward Rendell, co-chairmen of the Campaign to Fix the Debt, a project of the nonpartisan Committee for a Responsible Federal Budget.

Michael A. Peterson, chief executive officer of the Peter G. Peterson Foundation, a nonpartisan organization working to address the country’s long-term fiscal challenges, also said “Reaching this unfortunate milestone so rapidly is the latest sign that our fiscal situation is not only unsustainable but accelerating.”

One expert has pointed out that just the current unfunded liabilities amount to over 500 percent of last year’s gross domestic product, and paying them down would require 10 percent of the GDP for more than five decades, which is unlikely to actually happen at best.

More bad news came from the Federal Reserve Bank of New York, which published the US household debt and credit report on Tuesday showing the private debt of Americans reached the record $13.5 trillion at the end of 2018.

Though mortgage debt has gone down for the first time in two years, credit card borrowing matched the $870 billion mark it had reached prior to the 2008 crisis.

For Americans, the growing debt should be a concern, experts said, because over time it can push up interest rates for consumers and businesses. The higher rates can ripple through the economy, nudging up rates for mortgages, corporate bonds and other types of consumer and business loans.

A big national debt can also make it harder for the government to increase spending to combat the next recession or devote more money to retraining workers and helping the poor, among other programs.